who works with you to

grow your business.

Just Released!

A Newly Designed UI for Our Adaptable, Core Banking Platform

Read the press release for details on the redesign and scroll through the icons below for a description of services.

Core Processing

Document Control

Payment Solutions

![]()

Core Processing

View all your financial institution’s customer information, relationships, and documents in one place. With i2Core, you have the advantage of automated general ledger balancing, integrated budgeting, and the capacity to manage to hold company and branch accounting.

LEARN MORE

![]()

Core Processing

View all your financial institution’s customer information, relationships, and documents in one place. With i2Core, you have the advantage of automated general ledger balancing, integrated budgeting, and the capacity to manage to hold company and branch accounting.

LEARN MORE

![]()

Document Control

Improve security, compliance, and efficiency with i2Docs document imaging. With i2Docs you manage your documents and files according to your business needs. User-defined fields and controls give you flexibility while supporting bank process and policy compliance.

LEARN MORE

![]()

Payment Solutions

Maximize payment processing and increase customer loyalty with real-time integrations. i2Suite’s payment processing services include EFT and debit pay solutions, card control to your customers, and integration with IBT Apps’ i2OLB Bill Pay solutions.

LEARN MORE

![]()

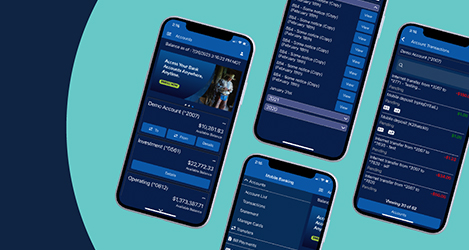

Digital Banking

Attract and retain customers with secure account access and management anytime, from anywhere. The i2OLB platform offers your customers online and mobile banking options and bill pay solutions. Your bank can support your business clientele better with commercial cash management.

LEARN MORE

![]()

Teller Capture

Increase productivity and cut costs with i2Teller. IBT Apps’ proprietary Teller Capture software empowers your tellers to verify transactions immediately at the teller line, speeding up service and helping to deliver an exemplary customer experience.

LEARN MORE

![]()

Operations Management

Manage all your back-office operations more efficiently with IBT Apps’ Operations Management software. i2Suite’s fully integrated environment includes remote deposit capture, ACH and Check21 item processing, customizable statement options, and check fraud prevention.

LEARN MORE

Digital Banking

Teller Capture

Operations Management

Core Processing

View all your financial institution’s customer information, relationships, and documents in one place. With i2Core, you have the advantage of automated general ledger balancing, integrated budgeting, and the capacity to manage to hold company and branch accounting.

LEARN MORE

Digital Banking

Attract and retain customers with secure account access and management anytime, from anywhere. The i2OLB platform offers your customers online and mobile banking options and bill pay solutions. Your bank can support your business clientele better with commercial cash management.

LEARN MORE

Teller Capture

Increase productivity and cut costs with i2Teller. IBT Apps’ proprietary Teller Capture software empowers your tellers to verify transactions immediately at the teller line, speeding up service and helping to deliver an exemplary customer experience.

LEARN MORE

Operations Management

Manage all your back-office operations more efficiently with IBT Apps’ Operations Management software. i2Suite’s fully integrated environment includes remote deposit capture, ACH and Check21 item processing, customizable statement options, and check fraud prevention.

LEARN MORE

Payment Solutions

Maximize payment processing and increase customer loyalty with real-time integrations. i2Suite’s payment processing services include EFT and debit pay solutions, card control to your customers, and integration with IBT Apps’ i2OLB Bill Pay solutions.

LEARN MORE

Document Imaging

Improve security, compliance, and efficiency with i2Docs document imaging. With i2Docs you manage your documents and files according to your business needs. User-defined fields and controls give you flexibility while supporting bank process and policy compliance.

LEARN MORE

Intelligently Integrated, Always Adaptable

Integrated Core Processing

Our premier core banking platform, i2Suite is an intelligently integrated cloud-based suite of products to help you run your community bank more efficiently and profitably.

Focused on Compliance

Keeping your bank technology in compliance can be managed proactively with our MNS Services. Leverage our knowledge and expertise to help you secure your entire infrastructure.

Dedicated Service & Support

As an IBT Apps’ client, you can depend on personalized training and ongoing education via webinars and online training sessions – all backed by our amazing support team.

A Modern Core Banking System –

What Does It Mean for Your Bank?

Learn what makes up a truly modern core banking system, why your bank

needs to invest one, and how your bank can onboard a new system without

all the headaches that usually accompany the transition.

Trusted by Over 100 Community Banks Nationwide.

CONNECT WTH US

Exploring new core providers?

We’d love to learn about your business needs and discuss how we can help.