Eliminate the complexities of deposit and loan processing with our dynamic suite of products.

The IBT Apps’ Deposit and Loan Origination Suite includes:

Features include:

Available for in-branch or online origination

Customizable preferences & policies based on your bank

Loan Origination Products

PowerLender®

Online and in-branch loan origination

With PowerLender, you have the ability to adapt to constantly changing market conditions, while also focusing on growth, lowering costs, and mitigating risk enterprise wide. Our flexible, business rules-based LOS complies with standard regulations and conforms to your lending processes today and well into the future.

With PowerLender, your bank can:

- Process every type of loan including conventional mortgages, FHA, VA, FHLB, and all portfolio products with ease.

- Integrate and work with 70+ third-party service providers.

- Customize screens, forms, reports, workflows, and more with built-in business rules configurability.

- Use LoanPilot™ to offer custom branded online applications for any loan type.

SecureLENDSM

Online and in-branch loan origination

SecureLEND is our state-of-the-art, loan origination platform, designed to modernize your bank’s lending process, so your bank can increase productivity and profitability. With an intuitive interface, automation capabilities, powerful product integrations, and built-in compliance standards, SecureLEND streamlines loan origination from start to finish and empowers your bank customers to effortlessly onboard products with a simplified application and expedited approval process.

With SecureLEND, your bank can:

- Accelerate processing for loan applications, verifications, credit approvals, and documentation, and cut delivery time.

- Fulfill all loan activities (including credit retrievals and underwriting) without ever leaving the platform.

- Automate HMDA, HOEPA, HPML and other HUD data collection and reporting.

- Drive cost-effective growth with cross-selling opportunities based on customer need.

SecureOPENSM

Online and in-branch deposit origination

SecureOPEN is our powerfully, simplified account opening platform designed for community banks to streamline their customer account application process and grow their business. With built-in automation, a dynamic decision engine, and advanced integrations with i2Suite and i2Mobile, SecureOPEN saves processing time, mitigates human error, and decreases compliance risk.

With SecureOPEN, your bank can:

- Personalize the applicant’s experience and customize auto decisioning.

- Customize specific fraud detection services to match your needs.

- Set multiple product offers, run campaigns, and select product types.

- Set up and customize customer email and text notifications.

i2DepositSM

In-branch account origination

If you’re simply looking for an in-branch account origination option that seamlessly integrates with our i2Suite core platform, look no further than i2Deposit, the key solution for all your in-branch account origination needs. With i2Deposit, you can efficiently open accounts for your customers while enjoying the convenience of a unified system that guides you seamlessly from start to finish. Say farewell to the complexities of managing various systems and navigating multiple windows. Thanks to i2Deposit’s seamless integration with i2Suite, you can effortlessly streamline the entire process with confidence and serve your customer more proficiently.

With i2Deposit, your bank can:

- Create new accounts and sync information to the core seamlessly.

- Reduce errors with single-entry and pre-populated information.

- Stay compliant with verification and approval procedures in place.

- Generate required doumentation, either electronically or in PDF format, with i2Suite’s seamless Trustage integration.

Partnering With TruStage for Compliance Documentation

To ensure our account origination suite meets the banking and financial services industry’s secure banking requirements, we’ve partnered with TruStage to provide a fully compliant document delivery system. Backed by extensive experience in financial transaction data analysis and documentation, TruStage provides end-to-end document solutions that can be customized and configured to fit all servicing and loan transactions. Plus! This documentation can be integrated with the core! No need to search for the correct forms; TruStage has you covered!

Count on One Solution for All Your Origination Needs

Delight your customers and stay competitive with an all-in-one, compliant solution.

Related Content

FEATURED PRODUCT

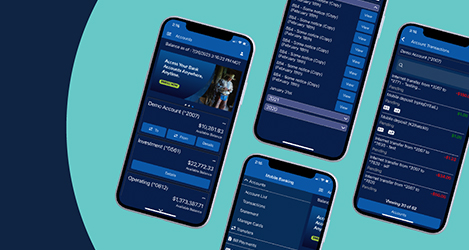

IBT Apps i2OLB – Digital Banking

Attract and retain customers with secure account access and management, anytime, from anywhere. The i2OLB platform offers your customers a range of deposit accounts to suit their needs.

FEATURED PRODUCT

IBT Apps i2Core – Core Processing