Intelligently integrated digital banking platform

Attract and retain customers with secure account access and management, anytime, from anywhere. The i2OLB platform provides a turnkey, branded digital banking solution so your financial institution can leverage today’s most cost-effective delivery channel.

Offer your customers the big-bank features they want:

Online and Mobile Banking Options

Provide your customers full-service banking on desktop, laptop, and mobile devices.

Bill Pay Solutions

Our integration partners make paying bills easy, with online bill pay.

Commercial Cash Management

Support your business clientele with the ability to manage business and personal accounts in the same internet session.

With i2OLB, your customers can:

View check and deposit images

Transfer funds between accounts

Make loan and bill payments online

Make stop payment requests

Receive real-time account alerts

Use secure messaging and file transfer

Receive e-statements and e-notices

Create and manage ACH payments and wire transfers

View account balances, activity, and monthly statements online, across accounts – including checking and loans

View remote deposits and more…

The following components build on the i2OLB digital banking platform to make a powerful set of features for personal and business banking customers.

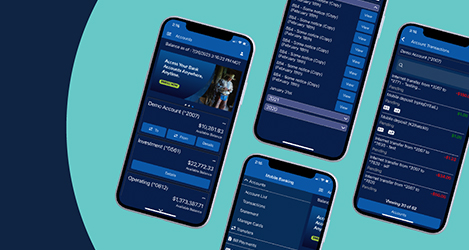

i2Mobile® and online banking for customers right where they are

We know that online and mobile banking are key to attracting and retaining customers, so we provide you with the means for allowing them to securely and reliably access and manage their accounts anytime, from anywhere.

With i2OLB and i2Mobile’s digital banking solutions, your financial institution can leverage today’s most cost-effective delivery channel branded for a seamless customer interaction.

Online bill pay for your customers and for your bank

Enhance your customers’ digital banking experience with a high-demand, intuitive digital payment solution. Online bill pay enables customers to manage and pay all their bills from their desktop, laptop, and mobile devices. Not only will customers benefit, but so will your financial institution.

Online bill pay opens up opportunities for your bank such as:

- Attracting and retaining retail and business customers

- Decreasing operating costs while increasing efficiencies by replacing physical payment and check processing

- Strengthening your competitive position in the market

- Increasing revenue potential with transaction-based fee income opportunities

Commercial Cash Management

Give your business customers the flexibility they need. i2OLB’s integrated banking platform provides a built-in commercial cash management solution that allows users to manage both their personal and business accounts, all in the same session. Your business customers can:

- View account balances and transactions in real-time

- Create ACH & wire templates

- Benefit from multi-level security with dual control

- View activity and user reports

- Protect your bank against check fraud with Positive Pay

- Create and upload ACH batches

- Manage ACH participation

- Submit wires for approval

- Provide approvals from anywhere through i2Mobile

Data compliance: safeguarding online banking information

Let’s face it: The digital space can be a scary place. We take safeguarding your data seriously, so you can offer your customers the web services they need with confidence.

IBT Apps leverages a variety of tools, frameworks, and resources to ensure our digital banking applications meet the banking and financial services industry’s secure banking requirements. When you engage with IBT Apps, you can expect a real-time, dynamic code review process during development and implementation, multi-factor authentication for your customers, and secure data transmission.

“We’re often told that the products we’re offering are as good, if not better, than their previous [big] bank experience.”

Mike Sale, CEO

The Commercial Bank

Online account management anytime, anywhere

Meet your customers where they are with i2OLB, IBT Apps’ digital banking platform.

Related Content

FEATURED PRODUCT

IBT Apps i2Mobile – Mobile Banking

FEATURED ARTICLE

A Short Guide to API Banking, BaaS, and Open Banking with Fintechs

Community banks can (and should) start considering API-based banking solutions. Read this short guide to learn the benefits and how to get started. No downloaded needed!

CASE STUDY

First National Bank – Eagle Lake, TX

Learn how this community bank provided a one-stop shop experience using integrated technology and responsive service.