by IBT Apps® | Oct 2, 2024 | banking technology, Lending, loan origination

This article was previously published in the October issue of Independent Banker Magazine. For many community banks, navigating the complexities of loan origination is like walking a tightrope without a safety net. Banks operating legacy systems often rely on manual...

by IBT Apps® | Jun 27, 2024 | banking technology, check scanning software, teller scanner technology

Not too long ago, the author of a financial blog for Millennials asked if we could explain to her readers the purpose of the strange printing at the bottom of a check. Bankers will quickly realize that our blogger friend was talking about the MICR line, the...

by IBT Apps® | Sep 22, 2023 | banking technology, IBT Apps News, Lending, loan origination

This post was previously published as a press release. Cedar Park, Texas: IBT Apps, a leading-edge provider of adaptable core and digital banking software, is proud to launch SecureLEND℠, a cloud-based loan origination platform. This comprehensive solution is designed...

by IBT Apps® | Sep 9, 2023 | banking technology, IBT Apps News, Lending, loan origination, Partnership

This article was previously published as a press release. The new partnership between IBT Apps and C2 systems integrates SecureLEND ℠, a modern, automated loan origination platform with IBT App’s i2Suite® Banking System. Cedar Park, Texas: IBT Apps, a...

by IBT Apps® | Sep 6, 2023 | acquisition, banking technology, IBT Apps News, loan origination

This article was previously published as a press release. Cedar Park, Texas: IBT Apps, a provider of adaptable core and digital banking software, is thrilled to announce its recent acquisition of PowerLender, a distinguished Loan Origination System, previously owned...

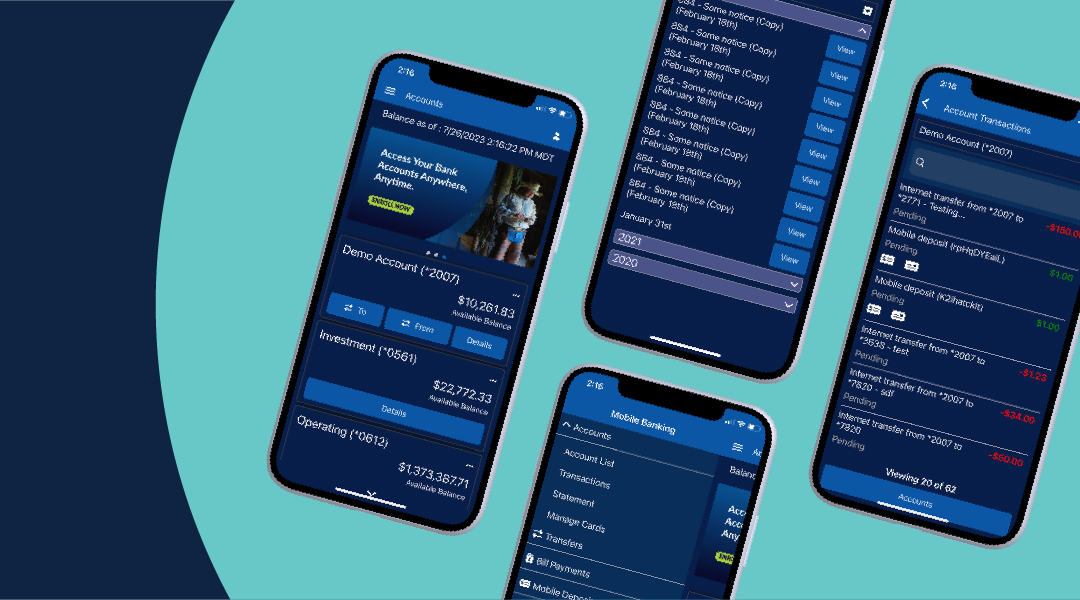

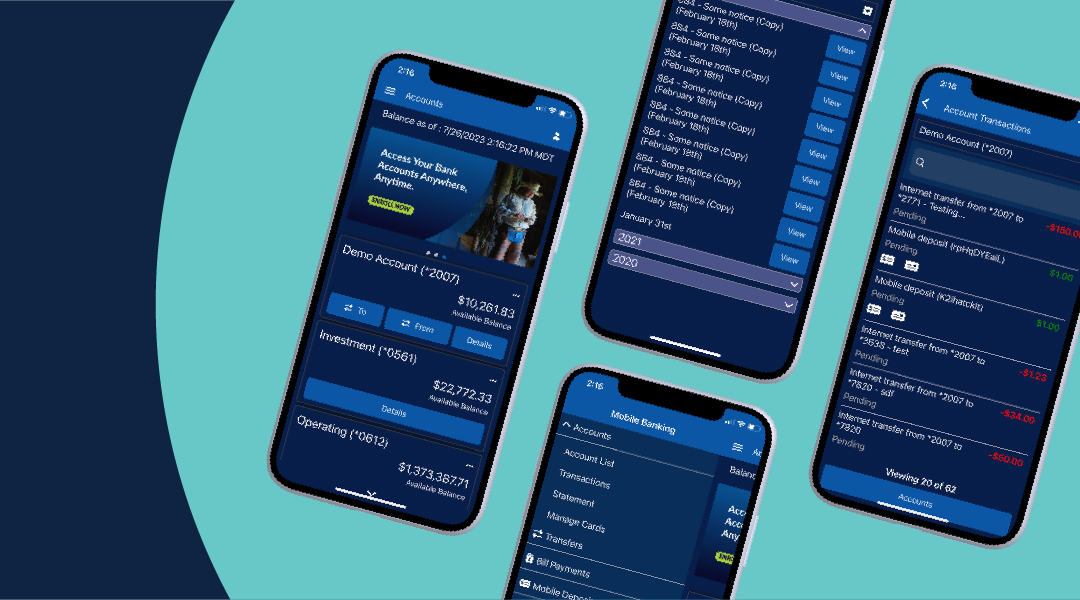

by IBT Apps® | Aug 30, 2023 | banking technology, IBT Apps News, mobile banking

This article was previously published as a press release. Cedar Park, Texas: IBT Apps, a leading-edge provider of adaptable core and digital banking software, is thrilled to announce the highly anticipated launch of their mobile banking application, i2Mobile. The...